Okay, so check this out—DeFi on Solana is blowing up fast, right? There’s staking rewards, yield farming, liquidity pools, and all these crazy protocols popping up every week. But managing your portfolio across all that? Man, it’s like trying to juggle water balloons. Seriously, the fragmentation is wild. You’ve got tokens scattered on multiple platforms, rewards dripping in at different intervals, and price swings that make your head spin.

At first, I thought I could just eyeball my holdings and rewards—just pull up a few wallet addresses and add stuff up manually. Nope. That quickly turned into a mess. I mean, how do you even keep track of staking rewards that compound automatically, or DeFi protocols that update their APYs like they’re changing their socks? Something felt off about relying purely on manual tracking, especially when you’re dealing with real money and volatile assets.

Here’s the thing. If you’re like me, you probably want one dashboard that tells you everything: your total portfolio value, how much you’re earning from staking, which DeFi pools are outperforming, and ideally, alerts when something’s fishy. But the reality is, most tools either focus on price tracking or staking rewards, rarely both in sync. And on Solana, where transactions zip by lightning quick, delays or inaccuracies can cost you.

Wow! Have you tried using spreadsheets? I did. For about a day. It’s a noble effort but quickly becomes a very very important reminder that humans aren’t built for this scale of data juggling. Plus, the DeFi space evolves so fast that formulas and trackers become obsolete almost overnight.

So, what’s a Solana DeFi user supposed to do?

Why the Usual Portfolio Trackers Just Don’t Cut It

At face value, portfolio trackers sound like the perfect solution. But many of them are designed with Ethereum or Bitcoin in mind. That’s a different beast. Solana’s ecosystem moves at warp speed, and user behavior is more dynamic. Initially, I thought I could adapt an Ethereum-focused tracker to Solana, but the differences in transaction speeds, token standards, and staking mechanics made that idea less practical.

On one hand, you want something simple and intuitive. On the other, DeFi protocols demand a level of granularity that most apps don’t offer. For example, many staking rewards on Solana accrue in real-time or near-real-time, and if your tracker refreshes every hour, you’re already behind. Though actually, there are some newer apps nailing this, but they’re often early-stage and a bit rough around the edges.

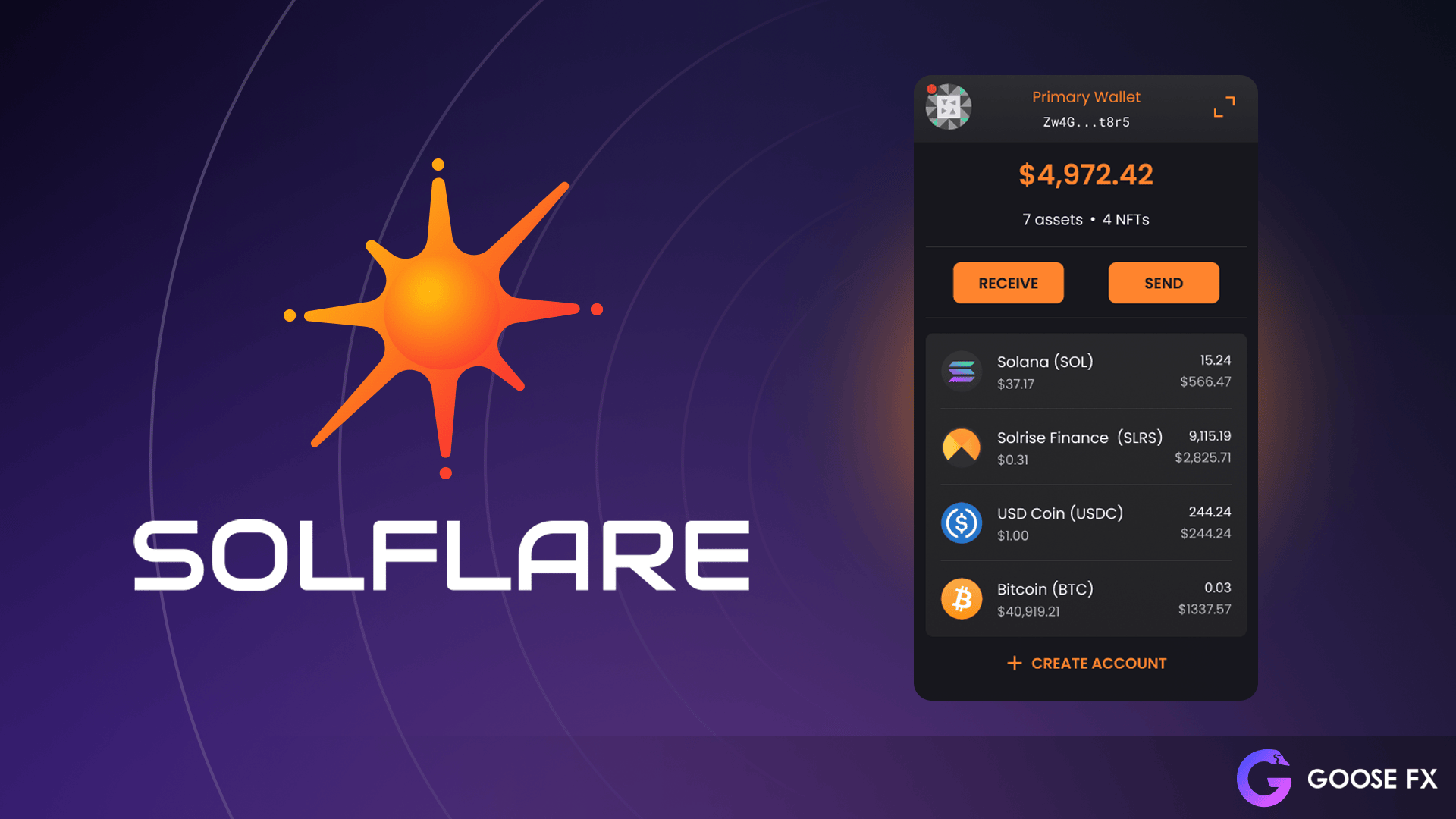

My instinct said to look for wallets that combine native staking features with portfolio tracking. That way, you cut out the middleman and get data straight from the source. This is where wallets like solflare come in handy—offering integrated staking rewards monitoring alongside your token balances, all within a user-friendly interface.

Hmm… I remember when I first started using solflare. The thing that surprised me was how it blends the wallet and portfolio tracker roles pretty seamlessly. No need to jump between 5 different apps just to see what your SOL and SPL tokens are doing. And the staking dashboard is surprisingly detailed without feeling overwhelming.

But here’s the rub: not all DeFi protocols integrate perfectly with solflare’s tracker. So, if you’re farming yields on some obscure pool, you might still have to check manually or use a secondary tool.

DeFi Protocols and the Staking Reward Maze

Let’s be honest. DeFi protocols on Solana are cool but can be a bit all over the place when it comes to user experience. Some protocols announce APYs that look too good to be true—because often, they are. And tracking your actual staking rewards versus the promised APY? That’s a challenge.

My first instinct was to trust the numbers on the protocol’s website. Big mistake. Rewards depend on total pool size, your share, unstaking periods, and sometimes governance decisions. Plus, there’s compounding frequency to consider. It’s a lot to wrap your head around.

So I started using solflare’s built-in features to monitor staking rewards directly on-chain, which helps cut through some of the smoke and mirrors. The wallet’s interface shows earned rewards in real-time, which makes it much easier to decide when to claim or reinvest.

But oh, and by the way, not every DeFi protocol supports direct integration. For those, manual tracking or third-party analytics is still needed. It’s a partial fix at best.

Then there’s the issue of protocol risk. Some platforms might suddenly change their reward structure or, worse, disappear entirely. Keeping an eye on your portfolio isn’t just about numbers—it’s also about staying informed on project health. This part bugs me because it’s a lot of mental overhead.

Really? Yeah. DeFi is exciting but also a bit like riding a wild bull. You gotta hold tight and keep your eyes open.

Personal Experience: How I Tried to Simplify My Solana Portfolio

I’ll be honest—when I first got into Solana staking and DeFi, I thought, “I can handle this.” But my portfolio quickly spread across multiple protocols: Raydium, Orca, Marinade Finance, and a few newer ones I stumbled upon. Tracking rewards alone was driving me nuts. I’d get notifications in my wallet, check some dashboards, then try to reconcile that with my own notes.

One weekend, I decided to go all in on streamlining. I switched to using solflare as my main wallet since it supports staking natively and shows real-time rewards. Honestly, this cut my tracking time in half. Instead of juggling five apps, I was down to one, and the integrated staking insights made a huge difference.

Still, I found myself double-checking everything against external trackers. Why? Because sometimes the numbers didn’t exactly match up, or I wanted to verify the APYs. That’s when I realized that even the best tools can’t fully replace your own due diligence.

Something else: I started receiving staking rewards in different tokens—some protocols pay out in governance tokens, others in SPL tokens. Managing and valuing these correctly across different platforms was a pain, especially with volatile prices.

So yeah, there’s no magic bullet yet. But solflare’s all-in-one approach is as close as I’ve found to a practical, user-friendly solution for the Solana ecosystem.

What’s Next? The Future of Portfolio Tracking in Solana DeFi

Okay, so here’s where it gets interesting. DeFi is evolving rapidly, and I think portfolio tracking will too. I’m seeing projects focusing on real-time on-chain analytics combined with AI-driven insights to flag risks or optimize staking strategies. Imagine a wallet that not only shows your portfolio but suggests when to unstake or which pools have better risk-adjusted returns.

Whoa! That’d be a game changer. But for now, we’re in a bit of a patchwork phase—where you use solflare for staking and wallet management, and supplement with specialized trackers or even good old spreadsheets when needed.

One thing’s sure: as Solana’s DeFi landscape matures, integration between wallets, protocols, and analytics tools will have to get tighter. Users want simplicity but also transparency and control.

Honestly, I think we’re on the cusp of seeing wallets evolve into full-blown DeFi dashboards. If that sounds out there, check out how solflare is already heading in that direction with staking rewards, token swaps, and NFT support all under one hood.

In the meantime, keep your wits about you. DeFi rewards are sweet, but the tracking challenge is real—don’t let it trip you up.

Frequently Asked Questions about Solana DeFi Portfolio Tracking

Can I track all my Solana DeFi investments in one place?

Mostly yes, especially if you use a wallet like solflare that supports staking and token management natively. But some newer or niche protocols might not integrate fully yet, so partial manual tracking could still be necessary.

How often should I check my staking rewards?

It depends on the protocol and your goals. Some rewards accrue continuously, so checking daily or weekly is usually enough unless you’re actively managing or reinvesting frequently.

Are there risks in relying on portfolio trackers?

Absolutely. Trackers can lag or miss updates, especially with rapid DeFi changes. Always cross-reference with on-chain data when possible and stay informed about your protocol’s status.