Regular audits and evaluations are needed to make sure compliance, as sturdy auditing capabilities verify all asset transactions are accurately recorded. Taking these elements under consideration supports correct financial portrayals and maintains stakeholder trust. It’s a call that requires cautious consideration of both financial coverage and the bodily realities of the asset’s use and longevity. By choosing the appropriate technique, companies can be certain that https://www.kelleysbookkeeping.com/ their financial reporting precisely displays their operational efficiency. Depreciation is a important idea in accounting and finance, representing the allocation of the cost of an asset over its helpful life.

Tax Price

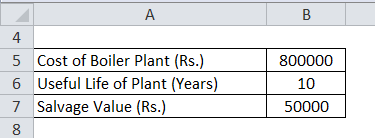

Now that you know what straight-line depreciation is and why it’s important, let’s take a look at how to calculate it. Uncover how the FCFE equation is crucial for valuation, serving to buyers perceive an organization’s true financial health and potential. Historical knowledge and industry benchmarks are crucial in estimating salvage worth. Completely Different kinds of belongings have distinctive traits that affect their salvage value. Fast technological change requires ongoing monitoring and analysis to estimate its impression on asset worth.

Double Declining Steadiness Method Formula (ddb)

From there, accountants have several choices to calculate annually’s depreciation. Corporations seldom report depreciation as a separate expense on their income statement. Thus, the money move assertion (CFS) or footnotes part are beneficial monetary filings to acquire the exact worth of a company’s depreciation expense. The formulation used to calculate annual depreciation expense beneath the double declining technique is as follows. Depreciation schedules provide an in depth report of how assets depreciate over time, making certain correct monetary reporting and compliance with accounting requirements.

Salvage Worth Calculation Strategies

This strategic perception supports decision-making for retiring, upgrading, or reselling equipment. This estimation suggests that the automotive will retain a worth of $5,000 at the finish of its useful life. By predicting this figure, you can also make informed selections about car alternative or disposal methods. Suppose a company spent $1 million purchasing equipment and instruments, which are expected to be helpful for five years and then be bought for $200k.

Elements corresponding to bankruptcy, installment agreements, and presents in compromise can prolong this era. Understanding the CSED helps taxpayers handle obligations and avoid extended assortment actions. The level of upkeep and upkeep performed on an asset throughout its lifespan can have an result on its salvage worth. Proper upkeep and common upkeep may help protect an asset’s situation and performance, increasing its salvage worth.

- This technological integration equips companies with the agility needed to thrive in a continuously evolving market landscape.

- The whole depreciation of an asset is calculated by subtracting its salvage value from its original buy worth.

- Changes in change rates can affect the worth of belongings in different currencies.

- It’s the value of an asset on the finish of its helpful life, and it’s used to determine the whole depreciation amount.

- The straight-line depreciation technique is a simple and dependable method to calculate depreciation.

The salvage worth is necessary for accounting purposes as it allows for the calculation of depreciation expense. Corporations estimate salvage value to find out the quantity to which an asset’s value is depreciated over its helpful life. By subtracting the salvage value from the unique price, corporations can calculate the carrying worth of the asset after depreciation. This carrying worth serves as an essential indicator of an asset’s remaining worth on the company’s stability sheet.

It’s the worth for which the asset could be bought or disposed of after it has served its purpose. Salvage value salvage value depreciation formula performs a key function in accounting, tax calculations, and total financial decision-making. If an asset’s end-of-life value is ignored or miscalculated, it could have an effect on depreciation bills, tax liabilities, and even profitability projections. It impacts the calculation of depreciation expense, which in flip impacts net income and tax liabilities.